Table of Contents

ToggleDiscover what makes eCommerce enjoyable in our Blog. Buy, inspect and release.

At Poppayai.com, we’re passionate about empowering shoppers and merchants to excel in the ever-evolving landscape of online commerce. Whether you’re a seasoned shopper, seller, e-commerce expert or just starting your business journey, our blog is here to provide you with the knowledge and resources you need to take your business to the next level.

By clicking on login/signup as vendor or buyer, you agree to abide by the Marketplace™ user terms & conditions.

All Blogs

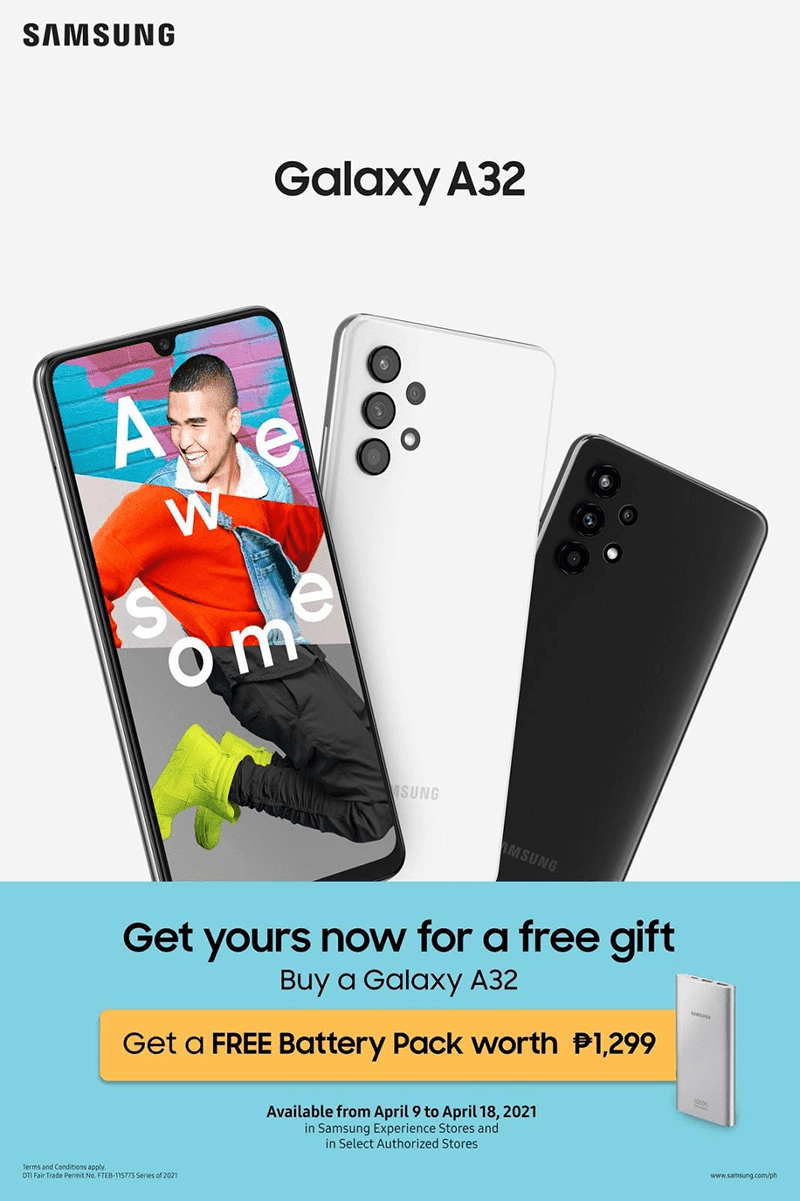

Unlock Affordable Elegance: Discover the Best Deal on a Used Samsung Galaxy A32

Elevate your mobile experience without breaking the bank with the “American Used Samsung Galaxy A32.” This flagship-level smartphone offers unparalleled performance, stunning visuals, and cutting-edge features at a fraction of the cost of a brand-new device. Whether you’re a busy professional, a budget-conscious student, or simply seeking an affordable yet reliable smartphone, the try “American Used Samsung Galaxy A32” for a convenient way to elevate your mobile experience without overspending.

Product Specifications and Condition

The “American Used Samsung Galaxy A32” boasts impressive technical specifications that rival the latest flagship models. Under the hood, you’ll find a lightning-fast Octa-core processor, 4GB of RAM, and 128GB of internal storage, ensuring smooth multitasking and ample space for all your apps, photos, and files. The vibrant 6.4-inch Super AMOLED display delivers stunning visuals with a resolution of 1080 x 2400 pixels, providing an immersive viewing experience for all your entertainment needs.

How Does Pay on Delivery Work in Nigeria?

As the e-commerce and retail sectors in Nigeria continue to evolve, the pay on delivery system is likely to remain an important payment option, but it may also undergo further changes and adaptations to address the challenges and limitations.

Pay on delivery, also known as cash on delivery (COD), is a popular payment method in Nigeria that allows customers to pay for their purchases at the time of delivery rather than upfront.

Understanding Pay on Delivery in Nigeria

Pay on delivery, also known as cash on delivery (COD), is a popular payment method in Nigeria that allows customers to pay for their purchases at the time of delivery rather than upfront. This method has become increasingly common in the country’s e-commerce and retail sectors, as it provides customers with a more convenient and secure payment option.

The pay on delivery system in Nigeria works as follows.

A Beginner’s Guide to Safe and Smart Online Shopping in Nigeria

Did you know that Nigeria’s e-commerce market is projected to reach $75 billion by 2025? The online shopping revolution is here, offering unmatched convenience and options right at your fingertips. However, as a beginner, navigating the world of e-commerce can seem daunting. This guide is your handbook to shopping online safely and smartly in Nigeria.

Getting Started with Online Shopping

In today’s fast-paced world, online shopping has become a way of life. With a few clicks, you can access a vast array of products from the comfort of your home or on-the-go. Beyond convenience, e-commerce offers wider selections, competitive prices, and often faster delivery than traditional brick-and-mortar stores.

While the benefits are plentiful, some beginners may have concerns about security, quality control, or simply feeling lost in the digital maze. Fear not! This guide will equip you with the knowledge and best practices to make online shopping a delightful and rewarded experience.

Our eco-friendly technology enable individuals to start selling their products in the global pay-on-delivery Marketplace™ easily. Start selling your virtual products on Poppayai.com Marketplace™ without ever having to see or handle them. Go virtual now!

Here’s what you can expect from our blog:

Expert Advice: Our team of e-commerce specialists and industry experts share their insider tips and strategies to help you optimize your online store, increase sales, and maximize your profits.

Trendspotting: Stay ahead of the curve with our in-depth analysis of the latest e-commerce trends and developments. From emerging technologies to shifting consumer behaviors, we’ll keep you informed about what’s hot in the world of online shopping.

Success Stories: Learn from the best! We feature inspiring success stories from real-life entrepreneurs who have built successful e-commerce businesses from the ground up. Get inspired and discover what it takes to achieve e-commerce success.

How-to Guides: Whether you’re looking to set up your first online store, improve your digital marketing strategy, or streamline your order fulfillment process, our step-by-step how-to guides will walk you through the process, making it easy to implement new strategies and tactics.

Industry Updates: Stay informed about the latest news and developments in the e-commerce industry. From changes in regulations to updates on major e-commerce platforms, we’ll keep you up to date on everything you need to know to stay competitive in the digital marketplace.

Interactive Community: Join our vibrant community of e-commerce enthusiasts! Share your thoughts, ask questions, and connect with fellow entrepreneurs in our comments section and on social media.